Home affordability has been a growing challenge across the country, leaving many wondering how long it will take them to save up to buy their first single-family home, and what life will be like with high mortgage payments and other monthly expenses.

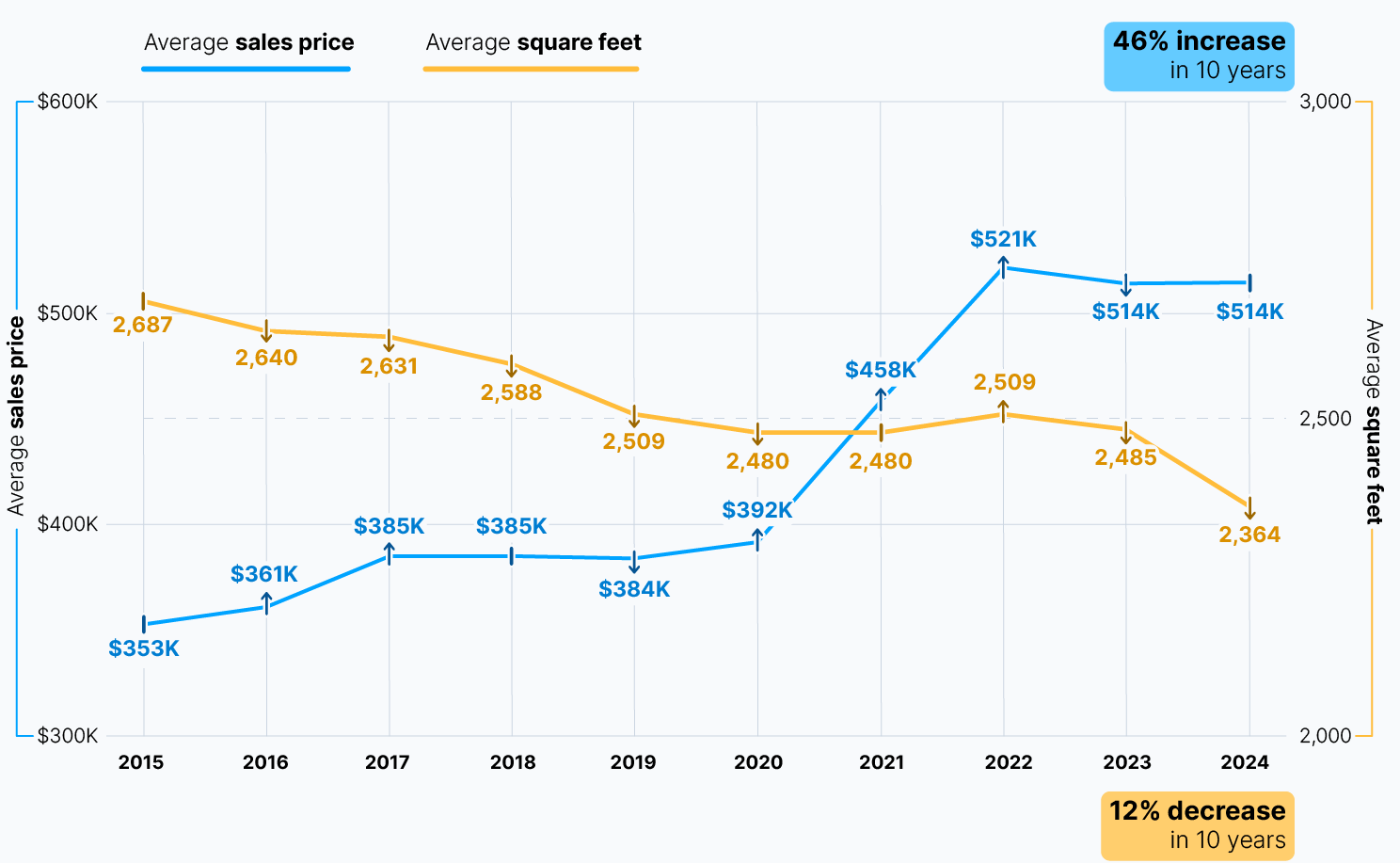

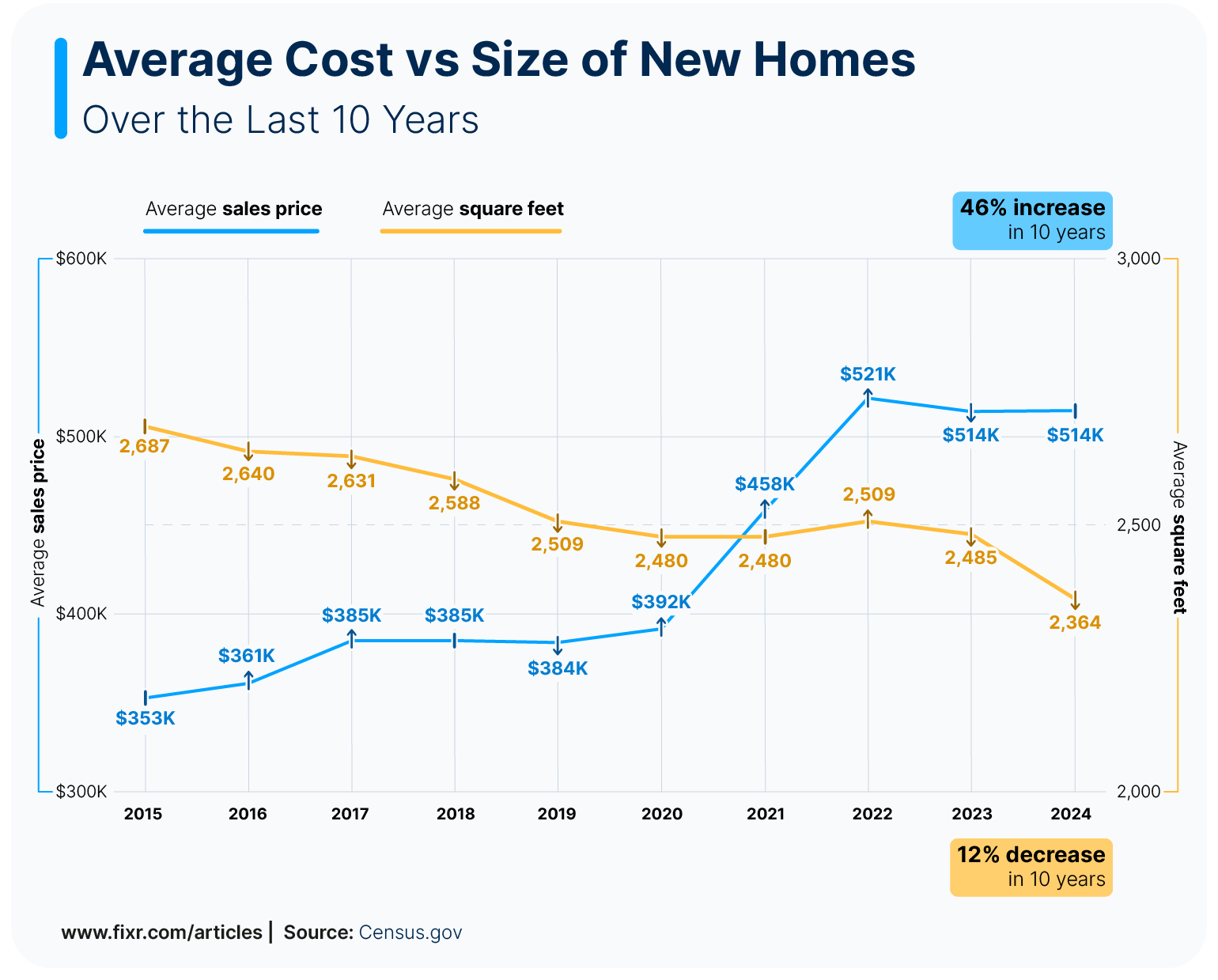

Home prices have climbed steadily over the past decade, but the space buyers get for their money has shrunk. The average size of newly built homes has dropped by more than 300 square feet, marking a wave of housing shrinkflation — paying more for less space.

After the pandemic, demand for larger homes briefly surged as families sought extra room for work and leisure. But as construction and land costs rose, that trend reversed. Today, buyers are once again choosing smaller, more affordable homes. When budgets are tight, as they so often are these days, house size is the first thing buyers are ready to compromise on, according to 41% of home construction experts we interviewed.

Summary:

Over the past decade, U.S. homes have become smaller but far more expensive.

The average new single-family home has dropped to around 2,364 sq ft, its lowest in ten years, while average prices have soared nationwide.

Factors like high mortgage rates, construction costs, and shifting buyer priorities are reshaping the housing landscape.

Many homeowners are trading square footage for affordability, efficiency, and sustainability, favoring smarter layouts and energy-conscious designs over sheer size.

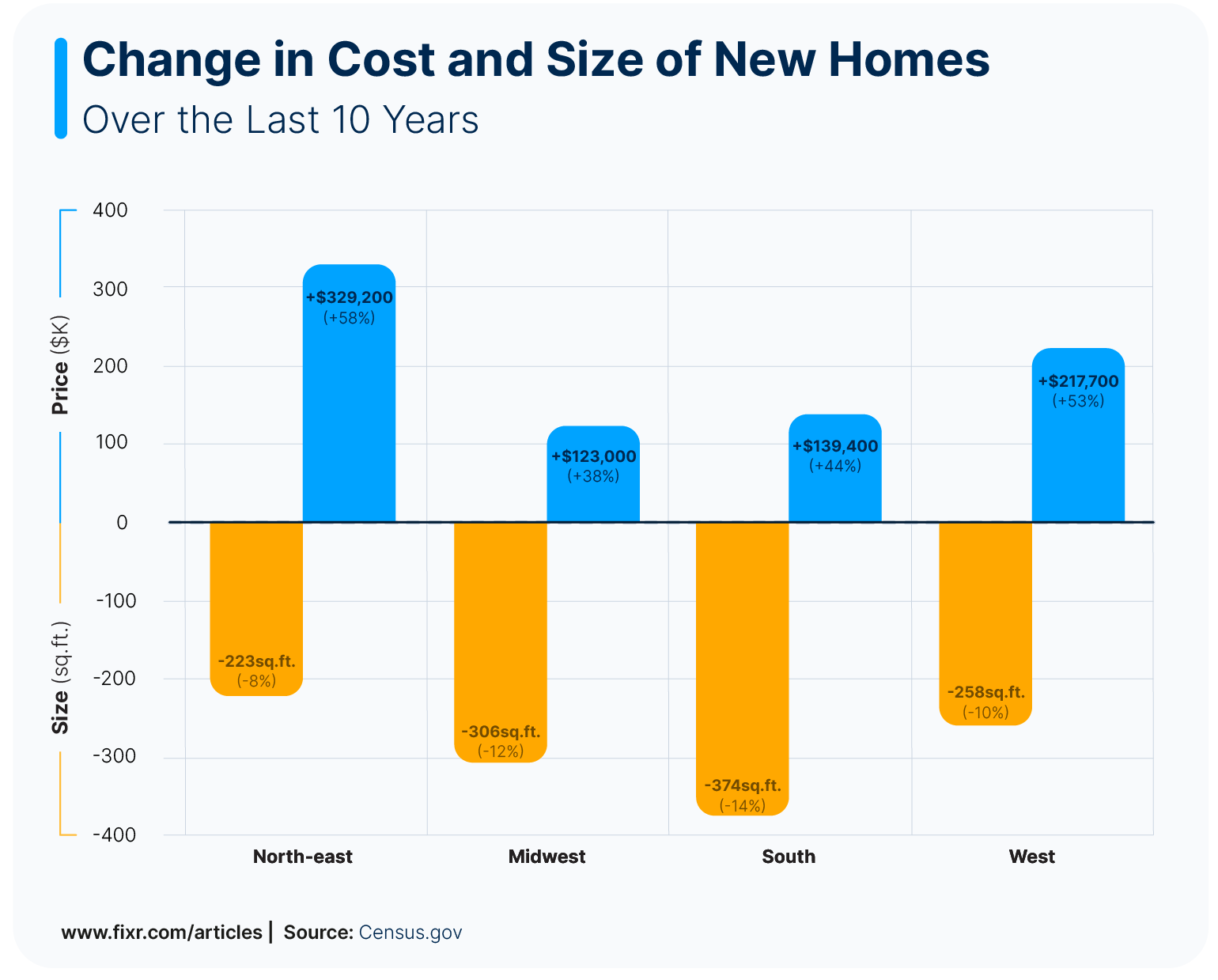

Regional trends tell the same story: homes have shrunk across the board, especially in the South and Midwest, yet prices continue to climb fastest in the Northeast and West.

Why are Homes Shrinking and Costs Soaring?

Several factors are driving the recent decline in home sizes. Rising construction costs have forced builders to scale back square footage to keep prices within reach for buyers. At the same time, higher interest rates and tighter budgets have shifted demand toward smaller, more efficient homes. Lifestyle trends also play a role. Many homeowners now prioritize energy efficiency, lower maintenance, and smarter layouts over sheer size.

The average size of new single-family homes dropped to 2,364 square feet in 2024. That’s the lowest point in 10 years, and 323 square feet smaller than homes built ten years ago. Couple that with the fact that the average new home sales price has risen by more than $161,000, a 46% increase in ten years. New homes have become more expensive while also getting smaller. However, it’s worth noting that home prices dropped slightly in 2023 compared to 2022, by about $7,500, and have remained at roughly the same level through 2024. While slight, it’s the biggest year-on-year drop in the last decade.

The average size of new single-family homes dropped to 2,364 square feet in 2024. That’s the lowest point in 10 years, and 323 square feet smaller than homes built ten years ago. Couple that with the fact that the average new home sales price has risen by more than $161,000, a 46% increase in ten years. New homes have become more expensive while also getting smaller. However, it’s worth noting that home prices dropped slightly in 2023 compared to 2022, by about $7,500, and have remained at roughly the same level through 2024. While slight, it’s the biggest year-on-year drop in the last decade.

Expert Analysis: The Factors Behind Housing Shrinkflation

Higher Costs, Smaller Footprints - Builders face increased prices for materials, labor, and land, leaving them little choice but to design smaller homes to keep final sale prices within reach. High mortgage rates, hovering around their highest levels in two decades, have also reduced buyers' budgets, forcing both builders and buyers to downsize.

Dimitri Zubrich, Realtor at Re/Max, says, "New homes are shrinking due to rising construction costs and the push for more efficient land use. Builders are reducing square footage by about 10% to keep homes affordable and sustainable."

I've noticed big builders feel pressure to maximize every square foot - yet keeping prices low isn't so simple.

Sustainability Leads the Way - Energy-efficient homes are easier to insulate, cool, and power, helping owners save on utilities while reducing their carbon footprint. Smaller floor plans use fewer resources and run on a lot less energy over the span of decades.

Pete Evering, Business Development Manager at Utopia Management, points to younger homeowners' lifestyle as one of the main reasons, saying, "Affordability certainly plays a huge factor here, as smaller homes tend to be cheaper to construct and maintain. However, I don't think it's the whole story. We can also credit the increasing popularity of smaller, more sustainable living spaces that are especially popular among younger homebuyers."

Home Buyers Have Budget Restrictions - Mortgage rates have hovered around 6.5-7% throughout 2024 and 2025, nearly double pre-pandemic levels, making monthly payments significantly higher even for smaller loans. Combined with record consumer debt and slower income growth relative to rising house prices, many buyers are stretching their budgets to the limit, prompting builders to scale down home sizes to keep new construction affordable.

Fitzgerald offers up an example that backs up the data: "One client wanted a 4-bed, 3-bath place under $400k. After months of searching, we realized the only options were cutting size by 10-15% or building an hour away."

Bob McCranie, Broker Associate and Team Owner at Texas Pride Realty Group, points to affordability first and foremost, commenting that "The average wages for Americans have not grown at the same pace as inflation. Home prices are way up, especially for new construction. Builder markups are often highly inflated and difficult to fight."

Why Home Prices Aren’t Falling As Much as Home Sizes?

Despite smaller footprints, prices have remained stubbornly high. Experts say this comes down to rising land costs, restrictive zoning, and buyers’ growing expectations for premium finishes and technology.

Cost does not necessarily shrink in direct proportion to the size of a home. This is because no matter how small the house is, builders still have to spend the bulk of their project expenses on what you might call non-negotiables or things that need to be in a home regardless of size.

Ryan Zomorodi, Co-Founder of Real Estate Skills, also believes the issue is due to an array of factors, saying, “New home prices aren’t reducing at the same rate as sizes due to persistent high land, materials, and labor costs.” He adds, “The strong demand for new homes and limited supply also allows builders to maintain higher prices.”

Average House Size and Cost by Region

The average size of an American home continues to vary widely depending on location. Smaller homes are now costing much more, especially in the Northeast and West, reflecting high demand and rising construction costs.

Region | Average home size 2024 | 10y Change in home size | Average home price 2024 | 10y Change in home price |

Northeast | 2,569 sq.ft. | -8% | $901,400 | +58% |

Midwest | 2,220 sq.ft. | -12% | $445,400 | +38% |

South | 2,376 sq.ft. | -14% | $454,700 | +44% |

West | 2,357 sq.ft. | -10% | $626,400 | +53% |

In the Northeast, the average new home size dropped to 2,569 square feet, down 223 square feet over the past decade. Yet, prices surged by $329,200, hitting an average of $901,400, the highest between the regions.

The Midwest saw the steepest size reduction, with homes shrinking by 306 square feet to 2,220 square feet. Still, the average price climbed $123,000 to $445,400, reflecting the region’s steady but more affordable growth.

In the South, homes are now 374 square feet smaller, averaging 2,376 square feet. Despite the drop in size, average prices rose $139,400 to reach $454,700, driven by strong migration and continued housing demand.

Meanwhile, the West continues to face some of the highest costs in the nation. The average home size there fell by 258 square feet to 2,357 square feet, while prices jumped $217,700 to $626,400.

Across all regions, one trend is clear: homebuyers are paying far more for less space. Rising construction and land costs, along with sustained demand, have made bigger homes harder to afford.

Balancing Space, Cost, and Future Value

Today’s homeowners are increasingly valuing efficiency, sustainability, and affordability over sheer square footage.

Regional trends highlight that larger homes remain common in some markets. Small homes and alternatives like ADUs and tiny homes are becoming practical solutions for many buyers. These options can offer lower operating costs, potential rental income, and competitive long-term investment returns.

Ultimately, choosing the right home size is about balancing space, budget, and future needs. By understanding market trends, zoning regulations, and the financial implications of different home sizes, buyers can make smarter decisions that meet both their lifestyle and financial goals.

FAQ

The average size of a new single-family home in the U.S. in 2024 is approximately 2,364 square feet. Over the past decade, home sizes have fluctuated, with a trend toward smaller, more efficient layouts as buyers balance space with affordability.

A 1,500 sq ft home is considered moderately sized, comfortable for a small family or couple. While smaller than the national average of about 2,364 sq ft, efficient design and open layouts can make it feel spacious and functional.

Yes, a 2,500 sq ft home is larger than the average U.S. house. This size typically offers multiple bedrooms, larger living areas, and extra spaces such as offices, dens, or extra rooms. It’s considered spacious for most families.

Two-story homes often range from 1,800 to 2,500 sq ft, depending on location and design. Because they build vertically, two-story homes usually offer more living space on smaller lots compared to single-story homes.

A typical 3-bedroom house in the U.S. ranges from 1,400 to 2,000 sq ft, though newer construction may be larger. The size depends on factors like layout, regional market trends, and whether the home is one or two stories.

Methodology

To analyze trends in U.S. home sizes and prices, we used data from the U.S. Census Bureau. We focused on the most recent available data for average home size and average sales prices.

Our approach included the following steps:

10-Year Comparison: We compared home sizes and prices over a decade, calculating both the absolute differences and percentage changes for each metric.

Regional Analysis: We broke down the data by region (Northeast, Midwest, South, and West) to identify geographic variations. For each region, we calculated the 10-year change in average home size and average sales price.

Trend Identification: Using these calculations, we highlighted patterns in home size reduction, price increases, and regional differences.

Irena is an industry analyst and content specialist at Fixr.com, SolarReviews, and Howmuch.net, where she transforms complex data into clear insights that help readers make smarter financial decisions. She holds a degree in Economics and has been conducting personal finance research since 2018, bringing a strong analytical foundation to her work. Her insights have been featured in reputable outlets such as the Washington Examiner, Yahoo Finance, Fox40, and Forbes.